Transforming the

lending journey for

a leading Bank’s customers

On a mission to modernize operations

A leading bank in New Zealand, is committed to delivering the best available banking products and services. It provides a range of financial services, including retail, business and rural banking, funds management, insurance, investment, and securities services.

While this bank is credited with introducing Internet banking to New Zealand, its systems fell short of its goal to leverage the true potential of the digital economy:

- The bank grappled with inefficiencies on various fronts due to siloed systems and legacy applications

- The loan application process was cumbersome, and document management was ineffective.

- The bank found it challenging to comply with evolving regulations efficiently.

- Customers endured suboptimal experiences due to manual operations, which resulted in delays, inconsistencies, and errors

The bank realized it had to undergo a digital transformation to balance the imperatives of customers’ digital expectations, optimal risk management, sustainable business practices, and cost optimization.

Leveraging the Pega advantage for banking success

The Areteans’ team, consisting of finance domain specialists and Pega experts, designed and implemented an innovative product for the bank. This new product is a comprehensive, Pega-based lending workflow solution catering to both retail and business customers at the bank.

This innovative solution is a reusable and flexible framework adaptable to various loan products. While implementing the project, our teams faced challenges, including coordinating with multiple teams across different time zones, navigating legacy applications, and managing data migration from old environments to a modern structure.

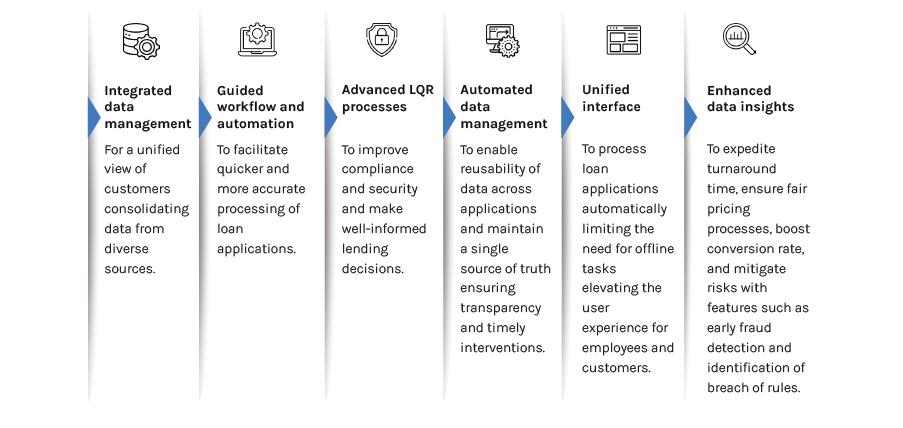

Despite these hurdles, the collaborative efforts of the Areteans and the bank teams enabled the successful implementation of the new product. The key features of the product are:

Driving lasting transformation

With this product, Areteans has enabled the bank to provide an enhanced digital banking experience to its customers and transformed employee experiences. With features such as centralized and secure data management and automated workflows, it has improved operational intelligence, catalysed prudent pricing decisions, and ensured compliance with regulations stipulated by the Credit Contract Legislation Amendment Act (CCLAA) and associated responsible lending code. This product has made a transformative impact on the bank’s operations:

Adoption of this product highlights the bank’s focus on innovation, efficiency, and customer-centricity. The bank remains committed to advancing towards sustained excellence in digital banking.

Contact us today to begin your transformation journey